By the time you are done, not only will you have a foundational understanding of modern computational methods in investment management, you'll have practical mastery in the implementation of those methods.

Return on maximum drawdown code#

We'll cover some of the most popular practical techniques in modern, state of the art investment management and portfolio construction.Īs we cover the theory and math in lecture videos, we'll also implement the concepts in Python, and you'll be able to code along with us so that you have a deep and practical understanding of how those methods work. We'll start with the very basics of risk and return and quickly progress to cover a range of topics including several Nobel Prize winning concepts. In this course, we cover the basics of Investment Science, and we'll build practical implementations of each of the concepts along the way. This course is the first in a four course specialization in Data Science and Machine Learning in Asset Management but can be taken independently. However, instead of merely explaining the science, we help you build on that foundation in a practical manner, with an emphasis on the hands-on implementation of those ideas in the Python programming language. This course provides an introduction to the underlying science, with the aim of giving you a thorough understanding of that scientific basis. What is the Accounting Rate of Return Table of Contents What is the Accounting Rate of Return?What is the Accounting Rate of Return formula?ExampleWhat are the advantages of the Accounting Rate of Return?What are the disadvantages of.The practice of investment management has been transformed in recent years by computational methods.How Liquidity of Stock Affects Its Future Expected Return The liquidity of a stock is of concern to traders who want to execute a large order at reasonable prices without making a big impact on the market.

The goal with hedge funds, as with any other investment, is to earn active returns.

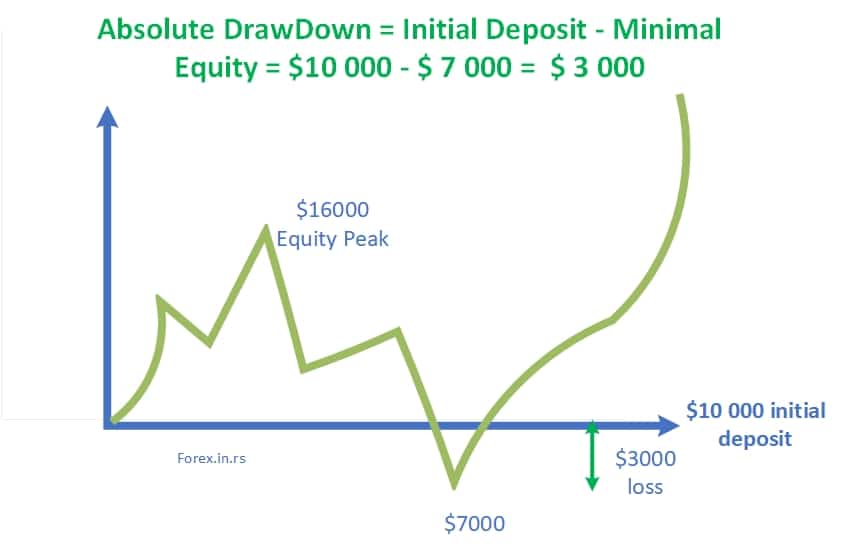

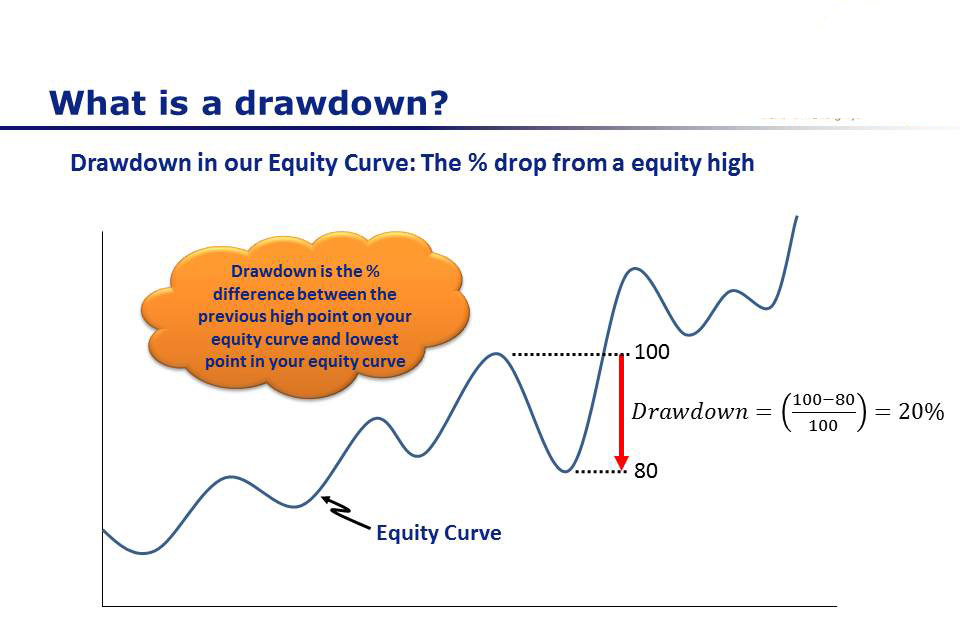

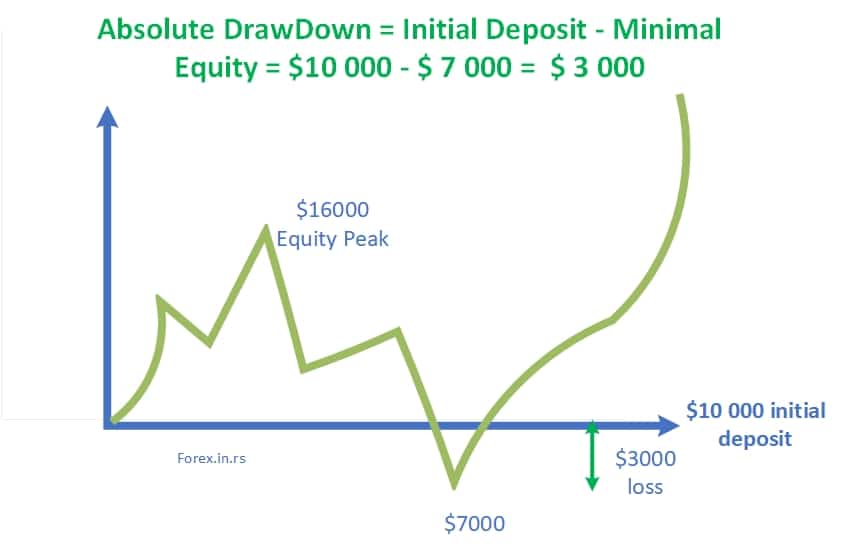

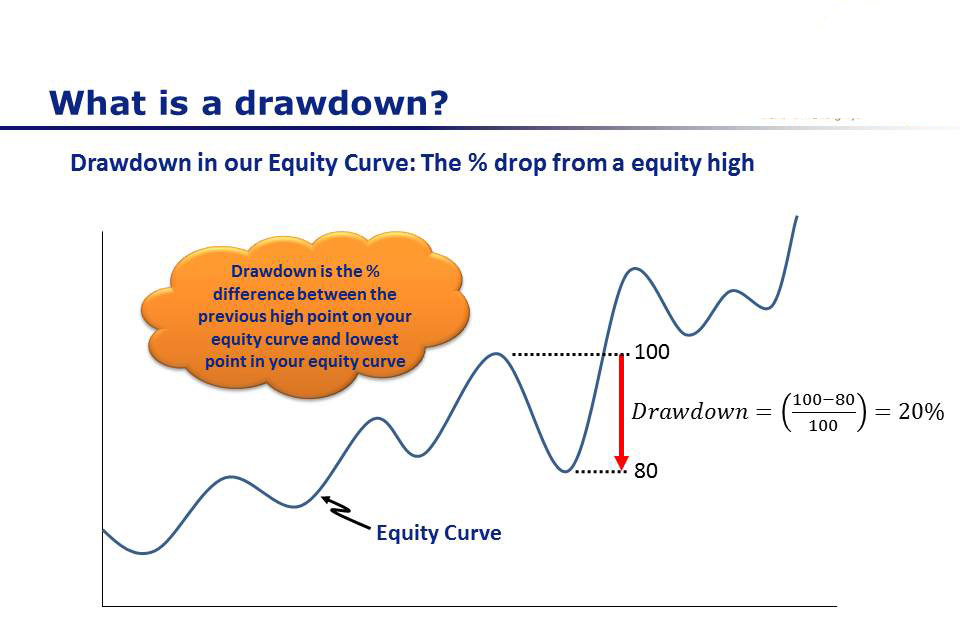

High-Water Mark in Hedge Funds Hedge funds represent alternative investments where investors pool funds and employ different strategies. Remember, compound growth is simply paying. Time-Weighted Rate of Return In order for us to have a clear idea of our compound growth rate, we must first understand the Time-Weighted Rate Of Return (TWR). Corporations are always looking for ways to grow their profits and this is done. Return on Investment (ROI): Definition, Formula, Example The ROI of a corporation is not just an investment, it’s the return on that investment. Return over maximum drawdown can be used to compare investments and to measure performance, but it does not directly measure profitability. The drawback to this measurement is that it only measures how well an investment manager has managed risk and does not directly measure how profitable returns are. It measures the average return of an investment over its worst loss since the beginning of the period under consideration. Return over maximum drawdown is a risk metric used in the hedge fund industry, which measures how well investment managers have managed risk. Return over maximum drawdown becomes less reliable at the extremes of the range, which makes it difficult to use for very risky or very safe investments. In order to use the return over maximum drawdown, there must be at least 12 months of historical data available to calculate statistics. It is only a measure of risk and does not directly measure profitability even though it can be used as a benchmark for performance. There are some drawbacks of the Return over maximum drawdown Return over maximum drawdown can be used as a benchmark for performance since it is a relatively new performance metric.ĭrawbacks of Return over Maximum Drawdown. Return over maximum drawdown can be used to compare investments and compare how different investment managers manage risk. Good risk management is best measured by return over maximum drawdown because it measures how well an investment manager has managed risk, rather than the profitability of returns. It’s a relatively new measure, so it has only been tracked in the hedge fund industry since the 1990s. Here are some benefits of Return over Maximum Drawdown: Many investors use the return over maximum drawdown to compare how different investment managers manage risks. The main benefit of return over maximum drawdown is that it’s a relatively new measure used in the hedge fund industry, which first started tracking this statistic in the 1990s.

0 kommentar(er)

0 kommentar(er)